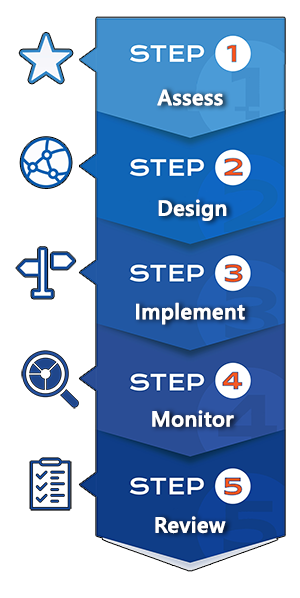

Our Process

Assess Your Needs and Risk Tolerance – We begin by getting to know you during a thorough planning meeting where we talk about your investment objectives, your liquidity and income needs, and your time horizon. We do not use canned checklists, but spend our time together getting to know you and what your wealth management will involve.

Assess Your Needs and Risk Tolerance – We begin by getting to know you during a thorough planning meeting where we talk about your investment objectives, your liquidity and income needs, and your time horizon. We do not use canned checklists, but spend our time together getting to know you and what your wealth management will involve.

Design Your Portfolio – Considering your needs and risk tolerance we will develop a portfolio that fits you and your wealth management needs.

Manage and Monitor Your Portfolio – We re-balance as necessary to keep your portfolio within the parameters we designed above.

Review Your Portfolio – We meet with you one on one to evaluate your portfolio progress and any additional wealth management needs you may have.

Produce State of the Art Reporting – So you are kept informed about the continued progress of your portfolio.

As your CPA/advisor we will gladly work with your attorney in coordinating your estate plan and making sure that you have the most tax efficient estate plan possible. The hassles and red tape associated with estate planning can be daunting, but you don’t need to do it alone. Our team is waiting to assist you through every step of the process.

Contact Us Today to Get Started